In the rapidly expanding world of decentralized applications in Web3, Radix is carving a name for itself as a comprehensive full-stack solution designed to eliminate everyday user and developer frustrations impeding the widespread adoption of DeFi.

Radix is a delegated proof of stake Layer-1 DLT that aims to revolutionize the dApp landscape by creating an intuitive, unified infrastructure that enables developers to design faster, more efficient applications with unprecedented composability and security.

Radix's vision for Web3 is one of flourishing innovation, facilitated by its unique Radix engine, programming language, Scrypto, consensus algorithm, Cerberus, and user interface, the Radix Wallet.

This article delves into problems facing DeFi today, the core offerings of Radix, and their problem-solving potential.

What Problems Is Radix Addressing?

The Radix platform is designed to tackle critical issues hindering the widespread acceptance and use of Web3 decentralized applications.

- Firstly, it tackles the issue of poor developer experience, often caused by the complexities of existing programming languages and limitations of smart contract environments.

- Secondly, Radix aims to solve the problem of flawed consensus protocols, which lead to inefficient transaction processing, high gas fees, and scalability bottlenecks.

- Lastly, it addresses the problem of poor user experience, which stems from confusing interfaces and unintuitive crypto wallets.

Each of these problems is explored in more detail below, shedding light on how Radix is poised to revolutionize the world of dApps.

Let's get right into it!

1.) Poor Developer Experience

Challenges of Using Solidity for Smart Contract Development

Solidity is regarded as one of the most reliable programming languages for developing smart contracts on the Ethereum blockchain. Like JavaScript, it allows programmers to write high-level code, making it easier to understand and use.

However, Radix highlights deep infrastructural gaps with how Solidity smart contracts and their environments treat what is arguably the most crucial element of any dApp: assets.

For example, there's no inherent notion of a 'token' in Ethereum, so tokenized assets like ATOM, ARB, or any other, except for Ethereum's native ETH, are simply separate ERC20 smart contracts that each hold a list of balances.

In the framework of code, these tokens are treated as auxiliary necessities and, in many ways, are placed on the back burner.

This setup implies that when developers set out to create dApps, they often dedicate 80% of their time building out asset behavior and other basic functionality parameters instead of focusing on business logic and user interface.

As a result, building the most user-centric components of a dApp often takes a backseat. This makes building less intuitive and delivers less than optimal results.

In the current framework, building dApps is so complex, lengthy, and convoluted that security gaps are bound to occur.

Considering the frequent high-profile hacks leading to millions in losses, as highlighted by numerous headline news every other week, the current state of DeFi security is simply unacceptable.

Solidity's Learning Curve is... Pretty Steep

Of an estimated 26 million developers worldwide, around 30,000 are full-time solidity developers. Of that 30,000, a large portion do not possess expertise in the language. In fact, the number of proficient Solidity developers capable of building market-ready dApps is slim.

This means Web3's growth depends solely on a limited pool of Solidity devs actually capable of building robust dApps, smart contracts, and on-chain functionalities.

Furthermore, Solidity's steep learning curve obstructs Web2 developers looking to transition into the Web3 space. This limits the available pool of competent developers and makes it virtually impossible for Web3 to reach global mass adoption.

To eliminate the steep learning curves needed to build in Web3, Radix has created a specialized smart contract environment that slashes the time it takes devs to launch their dApps. This environment is a product of the Radix Engine and programming language, Scrypto.

Let's talk about the Radix engine.

The Radix Engine: An Intuitive Smart Contract Environment

You can think of the Radix engine as an alternative to the Ethereum Virtual Machine.

Like its native programming language, Scrypto, the Radix engine is asset-oriented but in the framework of its higher-level smart contract execution environment. This means that an asset is treated as the core of its environment by design.

For example, in the Radix engine, tokens are perceived and treated as 'tangible' objects being transferred from one user account to another. These accounts, in turn, function like secure vaults safeguarding tokens under a user's control.

This presents a radical departure from today's conventional approach, where any transaction in DeFi is simply a message being dispatched to separate smart contracts that, while siloed, must communicate with countless other smart contracts to update your token balance within their internal registers.

In other words, the digital assets in your crypto wallet aren't really 'sitting' in your wallet. In fact, they're nothing more than balances within a smart contract.

To allow for the treatment of tokens as physical entities on a smart contract environment level, Radix employs a model known as the finite state machine for their tokens or assets.

This approach sets the Radix Engine apart from traditional smart contract methodology.

Exchanging Assets with the Radix Engine

So, what does the transfer of assets between users look like?

Much like everything else in the Radix stack, all transactions are asset-oriented. For clarity, let's define key terms in the Radix framework.

We'll start with buckets and vaults.

Vaults are where your assets permanently live, while Buckets are temporary containers where assets are sent when they are in transition.

In other words, when assets are in the process of changing ownership, they reside temporarily inside buckets during the period of the transaction before being sent to their new owner's vault.

When two users initiate an exchange, the desired tokens are transferred from each user's vault and placed into a 'bucket,' which, again, is a temporary container designed to facilitate any movement of digital assets.

The bucket immediately dispatches your tokens to the specified location, such as another user's bucket, and after completion of the exchange, to their vault for long-term storage.

Complex DeFi Trades: The Radix Engine's Transaction Manifest

The example above involves two traders engaging in a very simple exchange of tokens. However, in the real world, DeFi trades often involve several token swaps, exchanges, and actions in a single transaction.

To handle these transactions, Radix developed a built-in feature for Scrypto called the 'transaction manifest.'

Simply put, this feature meticulously outlines every step required to complete any particular transaction, no matter how complex. It promptly chains each step of the transaction in a single action.

If any step of the transaction encounters a failure, the entire transaction is promptly reverted, ensuring the integrity of the process.

This all-or-nothing trade execution mechanism is the crux of Radix's solution for achieving and maintaining atomic composability even as a dApp scales and transactions become increasingly complex, requiring additional steps to complete.

Atomic composability refers to the idea that every step in a transaction can be combined and validated in a single command.

Composability empowers developers to create dApps capable of managing multi-step transactions with ease and efficiency as they scale.

This results in a much safer and simpler way of handling digital assets, involving fewer smart contracts, fewer calls, and less room for error.

Let's now look at the programming language developers will use to create smart contracts within the Radix Engine environment.

Meet Scrypto: Radix's Asset-Oriented Programming Language

Scrypto is the programming language developers can use to take advantage of the Radix engine's unique features. By relying on the Radix Engine for all asset handling, Scrypto streamlines the process of creating and managing digital assets, allowing developers to focus on dApp functionality and business logic.

Like the Radix engine, Scrypto's coding framework treats assets, accounts, and permissions as critical players.

Instead of having them repeatedly built from scratch for every smart contract, they're a permanent, global feature of the platform, avoiding the need for isolated implementations over and over again as smart contracts.

Understanding Scrypto's Moving Parts

Smart contracts in Scrypto are called 'components' because of their unique functionality within the Radix ecosystem.

Unlike other frameworks where smart contracts merely hold data, Scrypto's components also hold vaults containing resources. In the context of Radix, resources refer to all assets such as tokens, NFTs, and cryptocurrencies.

Each vault is owned by a component, and a single component can possess multiple vaults.

A component's code outlines its vault, the data it contains, and the methods other components can utilize to interact with it.

The bare bone structure of a component is called a blueprint. Groups of blueprints are packages.

The Radix ledger, which is public and permissionless, serves as the deployment platform for blueprints. This setup allows developers to conveniently utilize the features of any existing blueprint if they so desire.

Furthermore, a well-structured Developer Royalty System is integrated into Scrypto. This system rewards developers with royalties whenever their blueprints are utilized by others.

Creating Tokens with Scrypto

Creating a token involves using Scrypto's built-in function and simply defining your desired parameters.

For example, if you were to create a token named 'MyCoin' with a quantity of a million, you would pass the name and the quantity into the resource creation function. The output would be a million 'MyCoin' tokens with your specified parameters.

This simple token-creation process can be accomplished with just a few lines of code and is an example of how asset creation with Scrypto is much simpler than an otherwise complex and lengthy process.

Let's now take a look at the problems facing consensus protocols today and how Radix’s proposed consensus solution, Cerberus, tackles them.

We'll start with the scalability trilemma.

2.) The Scalability Trilemma and Flawed Consensus Protocols

The scalability trilemma proposes that a blockchain cannot offer all three of these key features: scalability, security, and decentralization.

If one of these elements is improved, it comes at the expense of the other two.

- Scalability is the ability of the system to handle a growing number of transactions without affecting its performance.

- Security is the ability to ensure users are safe from malicious actors.

- Decentralization is the system's ability to run without a central authority or single point of control.

It is significant to grasp the scalability trilemma in order to comprehend the trade-offs of building blockchain technology.

Thus, finding a perfect balance between decentralization, security, and scalability is a significant hurdle blockchain technology must overcome to enable broader use and acceptance.

Various solutions, such as Layer 2s, claim to resolve the trilemma, but realistically, they introduce new challenges. For example, while L2s indeed boost scalability and reduce gas fees, they do so while sacrificing atomic composability.

This happens because L2s offshore transactions from L1 networks and process them in batches to boost throughput. And since L2s can have different protocols, environments, and execution layers, atomic composability breaks.

Atomic composability is the ability for multiple, often complex, transaction steps to be fulfilled for the overall transaction to happen.

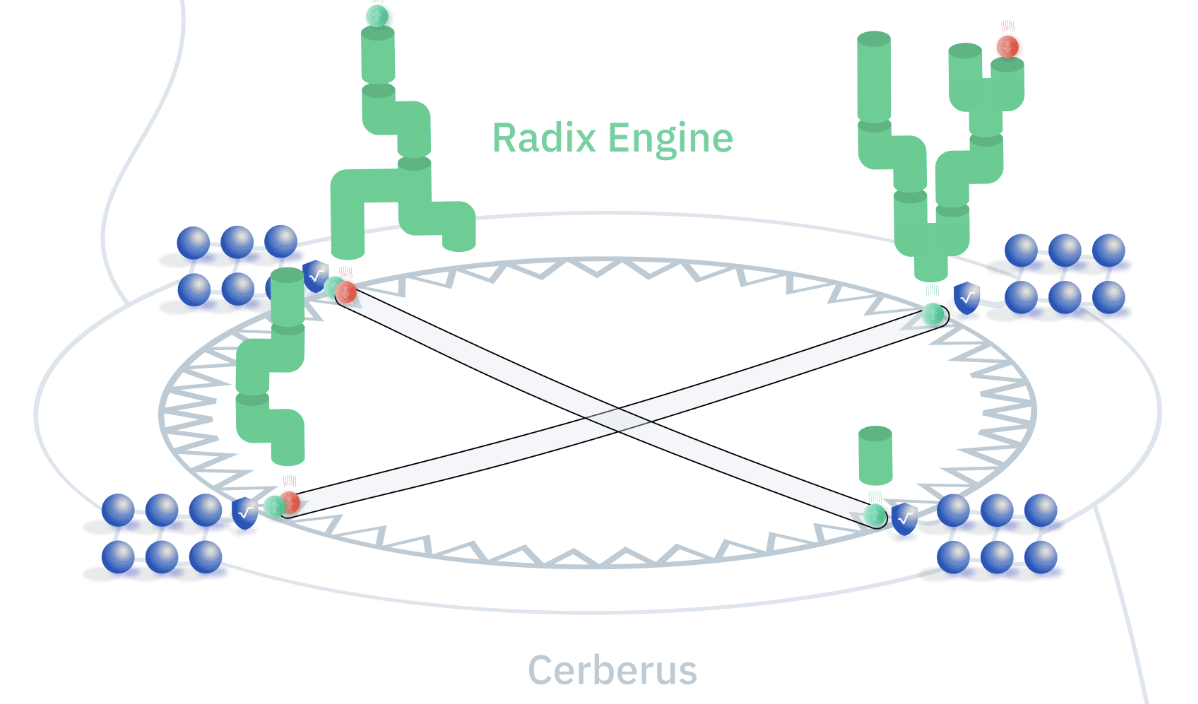

Meet Cerberus, Radix's Consensus Solution

Cerberus is a consensus protocol testament to a decade of extensive research and trial & error by Radix founder Dan Hughes.

Cerberus has been peer-reviewed by esteemed members of the University of California to verify its soundness as a multi-shard consensus protocol. It is among the few public ledgers to be tested to the highest academic standards.

(2022). RadixDLT. Retrieved November 1, 2023, from https://www.radixdlt.com/blog/cerberus-infographic-series-chapter-vi.

Ultimately, the review demonstrated that Cerberus is the most efficient consensus protocol, with the fastest throughput and lowest latency metrics compared to any other multi-shard consensus protocol like Chainspace.

Previously acquired by Facebook, Chainspace is a scalable decentralized infrastructure that executes smart contracts on a distributed ledger.

But how does Cerberus accomplish this?

To understand what Cerberus does differently, let's compare how 'traditional' consensus protocols process transactions and compare it to Cerberus' approach.

Traditional Consensus Protocols

Traditional consensus protocols compile ledgers of transactions and fully replicate them among all participants. These consensus protocols work in such a way that all participants, often referred to as "nodes," each maintain a complete copy of the ledger.

This ensures high transparency and security since nodes must agree on the transactions' validity. It also means that the ledger's integrity remains uncompromised even if one node fails or acts maliciously since other nodes retain the authentic records.

Furthermore, most existing consensus protocols leverage what is known as global ordering. This method of achieving consensus demands that all participants agree on the order of a series of events. This is done one event at a time, in a specific order, which has proven inefficient when considering throughput.

Unfortunately, by design, these protocols severely limit the transaction processing thresholds needed to address DeFi's goals of achieving mass adoption.

If billions of people are to depend on DeFi for their financial needs, an entirely different approach to achieving consensus is required.

Cerberus' Approach to Consensus

Cerberus allows blockchains to scale by leveraging a technique known as state sharding. The main objective of state sharding is to parallelize consensus agreement to boost throughput.

This is accomplished in two main steps:

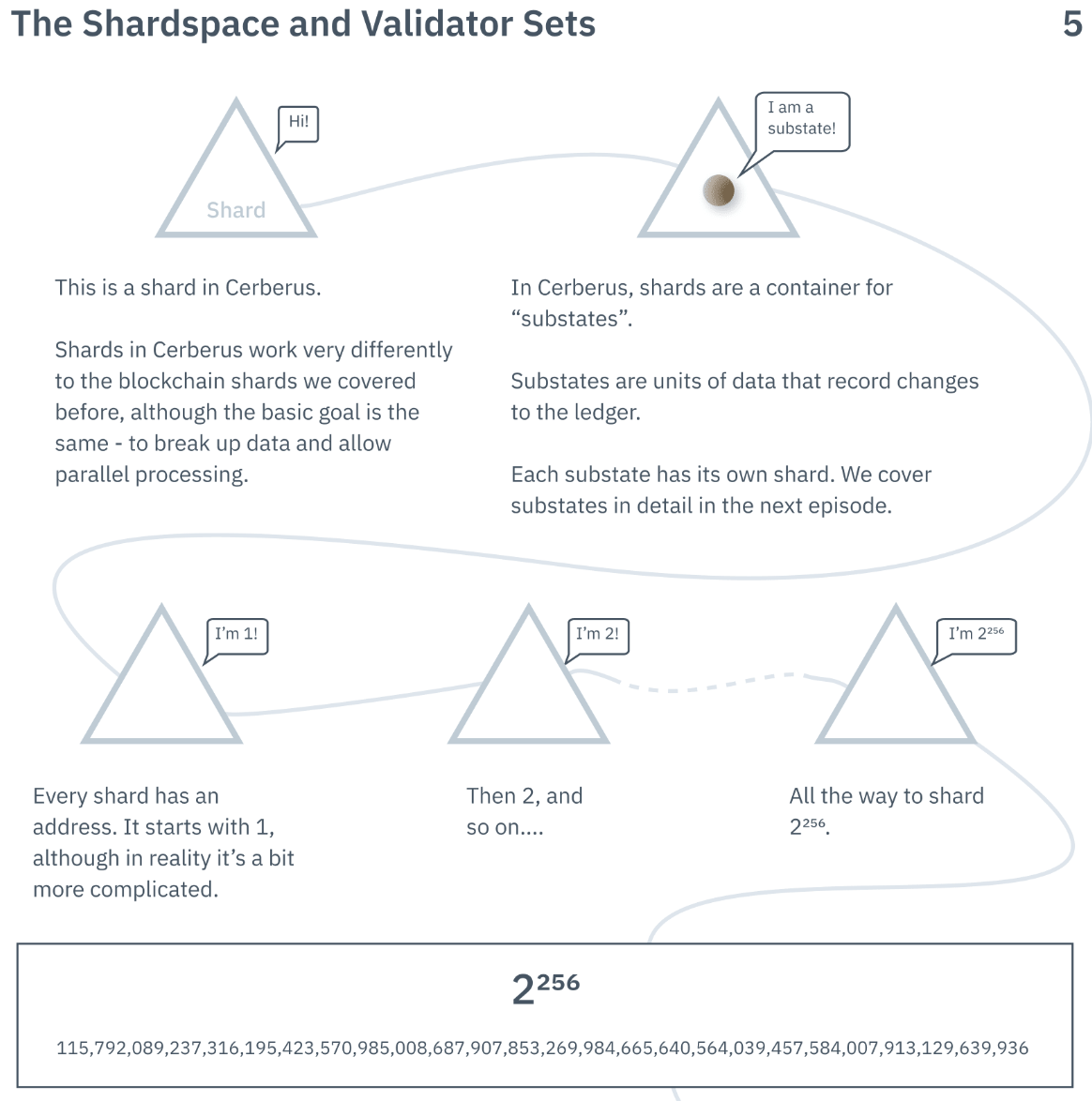

- Pre-sharding the ledger into 2^256 to provide limitless capacity for concurrent dApps and users, allowing Cerberus to achieve virtually endless parallelization.

- Separating unrelated transaction commands from one another to allow separate shards of blockchain transaction data to be processed in parallel simultaneously, ensuring that the performance of the blockchain doesn't decrease as the network grows.

See the graphic below.

Radix. (2021). The Shardspace and Validator Sets. RadixDLT. Retrieved November 1, 2023, from https://www.radixdlt.com/blog/cerberus-infographic-series-chapter-ii. text here

This is a shift from the conventional methodology, which implies a global ordering requirement and a single timeline.

This method makes consensus more efficient and organized as consensus participants are divided into smaller units, each focusing on its specific tasks simultaneously. Faster consensus means transactions on a blockchain can be processed quicker and more effectively.

Cerberus is projected to process over a million transactions per second (TPS) using this approach. This is an astounding feat, considering that the world's fastest blockchain, Solana, can only process 50,000 transactions per second.

Cerberus Scales While Maintaining Composability

Cerberus' ability to preserve composability even at scale is unprecedented. Composability in the framework of Cerberus refers to the ability of dApps on a network to interact and combine with one another frictionlessly.

Think of it as a bunch of friends working together on a project. Each friend or application has their unique skills, knowledge, and function. Successful and efficient collaboration will add tremendous value if these friends can combine their strengths quickly and effortlessly without communication issues.

Similarly, when composability is realized, each dApp can share data, functions, and features with one another to make the overall system more interconnected and efficient.

This improves the operations of individual applications and strengthens the entire network. It fosters an environment where all sorts of new dApps can flourish, allowing the Web3 experience to be much more rewarding.

Let's now shift our focus to what is arguably the greatest hindrance to Web3 adoption: the user experience. We’ll also take a look at some projects that launched on Radix.

3.) Poor User Interface = Poor User Experience

Whether a developer or a non-technical user, you've probably endured countless moments of Web3 frustration. For example, you've grappled with unintuitive crypto wallets while sending, exchanging, or safeguarding your funds.

At your peril, you've memorized or stored long, puzzling seed phrases that act as the only access to your digital wealth. Not to mention dealing with the complex jumble of numbers and letters that make up wallet addresses, which essentially act as your digital identity.

Furthermore, deciphering transaction fees, gas costs, and hash rates can be overwhelming, especially if you're not well-versed in the language of cryptocurrency. The need for self-education and constant vigilance to protect your assets adds another layer of complexity.

This underscores the importcance of the developer's work in making Web3 more user-friendly, intuitive, and secure for everyone, irrespective of technical proficiency.

Security is Required for the Growth and Adoption of DeFi

In just two years, DeFi grew from a billion dollars under management to over 200 billion dollars. While this is an incredible achievement, it is relatively miniscule when compared to the 400 trillion dollar global financial system.

Radix identifies poor security as a core factor stifling DeFi's growth, and rightly so. DeFi has seen a whopping 6 billion dollars vanish due to smart contract breaches. The reputational damage caused by these attacks discourages everyday folks from putting their hard-earned cash into Defi platforms.

For DeFi to become a key player in the world's economic structure, it must overcome these security challenges and assure users that their investments are safe.

Unless there are concrete changes and advancements in the security of the whole ecosystem, the dream of mass adoption of DeFi will remain a dream

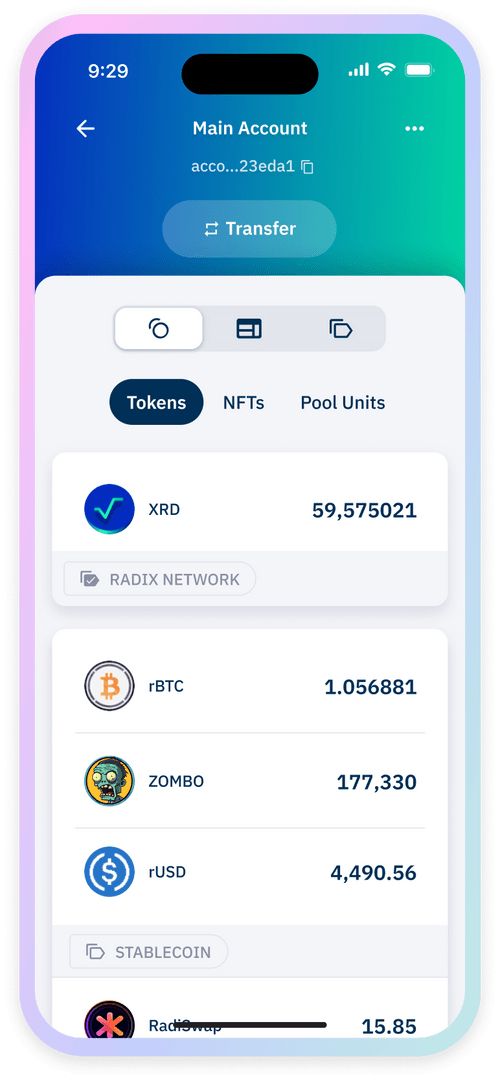

The Radix Wallet: A Wallet Grandma Can Use

As discussed, having a robust backend is essential, but developing a user-friendly front end that is intuitive, non-intimidating, and expertly optimized for everyday users like our family and friends is equally important.

The Radix Wallet achieves this by providing users with an intuitive display of all their digital assets.

(2022). The Radix Wallet. Retrieved November 1, 2023, from https://www.radixdlt.com/wallet.

The Radix Wallet's capabilities extend beyond just a single device. Its p2p Radix Connect feature allows interaction with dApps across multiple platforms, such as mobile and desktop while eliminating the necessity of transferring seed phrases between devices.

In addition, the wallet introduces Radix Personas. This feature offers decentralized logins, allowing users to log into any Radix dApp or service without needing a password. It protects privacy by allowing users to expose precisely the data needed by the dApp to log them in.

Last, and perhaps the most important upgrade introduced in the Radix Wallet is the transaction manifest.

In today's DeFi, when completing a transaction, you're presented with a jumble of letters and numbers called a 'hash' and underneath it a button that reads 'sign.'

When you click on that 'sign' button, you're essentially submitting your wallet, its balance, and its entire fate to the hands of a program. With every transaction, you're risking that your assets become irretrievably lost.

Instead of signing an unreadable hash and hoping for the best, the Radix Wallet's transaction manifest feature provides you with a human-readable interface.

In other words, as a user, you can see exactly how much is coming out of your wallet, where it's going, and what you're getting in return. From there, you can either accept or refuse the transaction.

With the Radix wallet, you are in full control of your transactions, just as if you're dealing with a traditional banking app.

Let's shift gears and take a look at some projects running on Radix, starting with AlphaDEX.

Projects Building on Radix

AlphaDEX: A Backend for Enhanced Liquidity and Optimal Trading

A problem we often see in DeFi exchanges is fragmented liquidity pools with low-volume trades. Among many problems, this makes it challenging for traders to execute larger trades without significantly impacting the market price.

How does AlphaDEX tackle this?

AlphaDEX is a decentralized order-book-exchange platform that takes advantage of Radix's unique infrastructure. AlphaDEX inherits Radix's excellent composability, allowing an endless variety of dApps to seamlessly integrate on top of it.

With said composability, AlphaDEX addresses the liquidity problem by connecting dApps running on its platform. This allows liquidity and trading volume from these dApps to be pooled together to create a thriving DEX environment for users. As such, AlphaDEX acts as the central hub for liquidity that all dApps can utilize to their advantage.

This not only enables traders to execute larger trades without causing drastic market price fluctuations but also greatly enhances the overall trading experience by reducing slippage.

Furthermore, integrating various dApps onto AlphaDEX's platform increases the diversity of assets available for trading, thereby attracting a larger user base and leading to even greater liquidity.

AlphaDEX has a fee structure in place that incentivizes strategic market-making orders to enhance the overall liquidity of the platform. It also encourages devs to build frontend dApps onto their platform.

The fee structure is implemented as follows:

- AlphaDEX encourages market makers to take calculated risks by offering them up to 0.35% in fees should they successfully fulfill orders that are reasonably distant from existing market prices.

- They also offer all frontends 0.1% in platform fees to encourage devs to plugin their dApps.

A noteworthy feature of AlphaDEX is that every trading pair is a separate Scrypto component (the smart contract version of Radix.) This allows pairs to trade independently, allowing trade throughput processing speed to be incredibly high.

Developers building dApps on AlphaDEX can benefit from its native asset-oriented framework on a linearly scalable network designed for mass adoption of DeFi.

Let's take a look at one such dApp, DeXter.

DeXter: A Community-Driven dApp on Radix

DeXter is the first order book exchange dApp on the Radix network built entirely by a self-governed group of passionate volunteers from the Radix community.

DeXter is built on top of AlphaDEX and functions as one of its front-end applications and user interface. Its primary source of revenue comes from the 1% platform fees paid out by AlphaDEX.

DeXter is expected to launch in the near future after Radix's Babylon went mainnet last month. It will offer basic spot market and limit order functionalities and is expected to undergo beta testing on Stokenet under the stewardship of its community before going mainnet.

As a project built entirely by a diverse group of talented volunteers, DeXter has a unique cultural commitment to fostering an inclusive and dynamic DeFi ecosystem.

DeXter strongly emphasizes community collaboration, offering attractive participation incentives through its native $DEXTR tokens.

In an asset-oriented environment, projects like DeXter issuing tokens provide numerous advantages. Predominantly, they serve as a tool for value transfer within the ecosystem, facilitating transactions and exchanges between participants.

By issuing their native $DEXTR tokens, DeXter fosters a sense of ownership among its community members, aligning their interests with the project's growth and instilling greater stakeholder commitment.

Overall, its token mechanism not only strengthens the internal economy of the project but also aids in promoting transparency, enhancing trust, and encouraging long-term participation.

As DeXter continues to evolve, it is set to demonstrate how building on the Radix stack raises the standards for decentralized trading and reshapes the DeFi landscape.

Conclusion

In summary, the Radix platform emerges as a comprehensive solution that addresses the fundamental challenges of the Web3 space, including poor user and developer experiences and flawed consensus algorithms. It is designed to provide a unified infrastructure that enables developers to build more robust, efficient, and superior dApps with a user-friendly interface.

Radix achieves this through its unique Radix engine, Scripto language, Cerberus consensus algorithm, and intuitive user interface, the Radix Wallet.

The platform addresses critical issues in the industry, such as poor security for DeFi users and a limited pool of proficient Solidity developers.

Its wallet offers a user-friendly experience with advanced features, secure logins, and seamless interaction across devices, providing an unparalleled digital ownership experience.

By addressing the complexities and vulnerabilities inherent in current blockchain technologies, Radix has the potential to revolutionize how developers create and how users interact with decentralized applications.

Its robust Cerberus consensus algorithm and flexible Scripto language offer a significant advantage over existing platforms, promising a future where Web3 is accessible and beneficial to all.

DeXter and AlphaDEX are shining examples of innovative projects that embody the transformative potential of Radix. They leverage the power of the Radix stack to deliver a linearly scalable, composable, and community-driven decentralized exchange, shaping the future of digital asset trading.

Launching DeXter's native $DEXTR tokens is a pivotal step towards promoting value transfer and instilling a sense of shared ownership among its members.

As it embarks on beta testing and prepares for mainnet release, DeXter remains committed to breaking new ground in DeFi and in doing so, empowers the Radix DLT to become the stack solution behind the mass adoption of Web3.